If you’ve been online lately, you probably know that a lot of people were losing money by speculative investing in Reddit-promoted meme stocks. Perhaps you are one of the people who did this, in which case I hope you bought early and sold high.

A lot of people were understandably confused about what was happening because investing is complicated, but they wanted a chance to make money and stick it to the evil hedge funds. This isn’t what really happened. But it underscores that even with the rise of “democratized” investing platforms, the benefits of investing don’t necessarily become more accessible.

The best investing advice is boring: Don’t buy individual stocks. Stick your money into low-cost index funds and wait.1 Do this and your wealth will grow over time, slowly but surely. Again, this isn’t as fun as speculative investing in memes—you don’t get to pretend to be hurting billionaires—but it is good advice.

Don’t Get Mad, Get Even

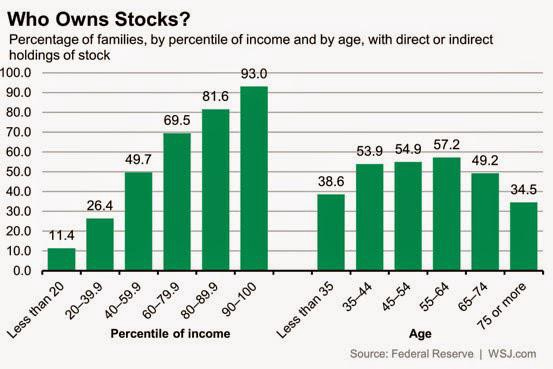

No amount of good investment advice is going to solve for the fact that there are a many people who simply don’t have the money lying around to invest. The stock market generates a lot of wealth, but if it doesn’t feel this way to the average person, it’s for good reason.

Almost all wealthy people own stock, but rather few poor folks do. The well-to-do can also afford to hire people to manage their investments and give them sensible advice.2 There are far too many barriers that lock out lower-income Americans from sharing in the bounties of the market.

The solution is not egging individuals on into throwing their money into delusional pump-and-dump schemes. You are not going to make a significant dent in Wall Street doing this, even if you manage to get lucky and make a quick buck. There’s a better way.

Looking Towards Alaska

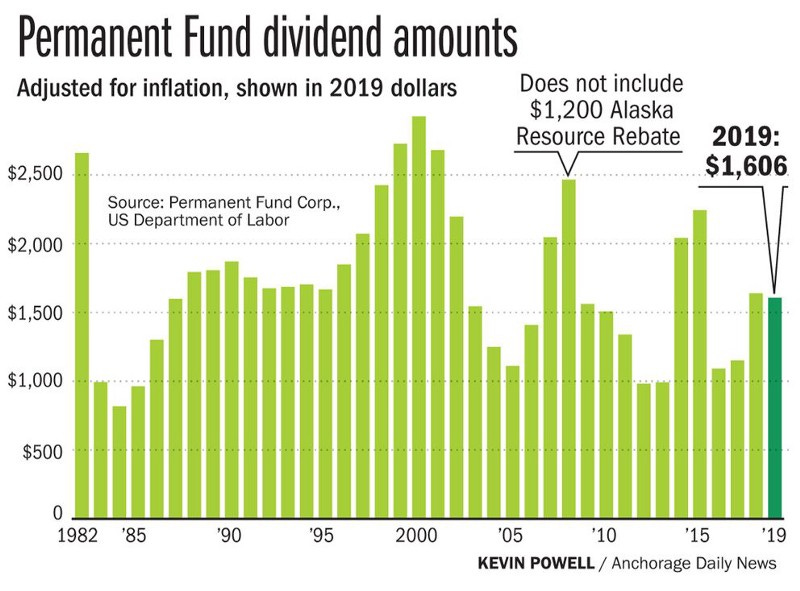

In the 1980s, Alaska decided to start putting a portion of the revenue the state generated off its oil and mineral reserves into the Alaska Permanent Fund (APF). The APF invests this money and pays out a portion of the gains to almost all residents,3 every year. The amount received per-resident varies year-to-year depending on the fund’s performance.

The fund typically pays out at least $1,000 in 2019 dollars. The program is considered one of the closest things to a real world implementation of a Universal Basic Income. The idea behind it was sensible, invest the profits from Alaska’s finite natural resources so they could generate wealth well into the future. Wealth that could be distributed to every resident.

The APF and its dividend are really popular in the state, as one might guess. It has been really helpful for many: one study found that dividends from the fund reduced poverty by 20%. This was particularly the case in rural areas, where many Native Alaskans live.

Create The Sunshine Fund

Currently, Arizona has a budget stabilization fund, better known as the “Rainy Day Fund,” used to patch holes in our budget during tough economic times. It’s also good if you want to put lots of money into it and then brag about how big it is.

What I’m proposing is a Sunshine Fund, investing in the market and paying out a portion of the gains annually to every resident in a similar manner to the Alaska Permanent Fund, regardless of economic conditions.

Could Arizona do this? It seems difficult on the surface. We lack the oil production of Alaska, all while having significantly more people. Still, we could finance this in several ways if we wanted to, which I’ll explore below:

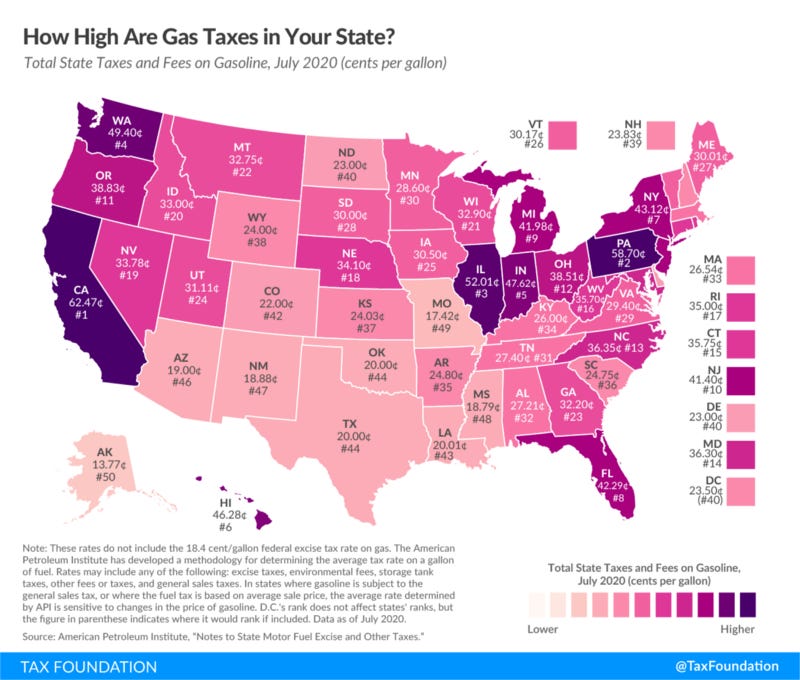

Raise the gas tax. The gas tax has not been raised in Arizona since the 90s. This revenue is generally used to fund highway and road repairs and construction. This tax usually gets flack for being a regressive tax, but using the revenue to send out a dividend would likely negate the regressive effects. In 2017, the Arizona gas tax brought in $504 million in revenue.

In recent years, there have been proposals to double the state fuel tax to pay for infrastructure, although that has yet to be successful.

Land Value Tax. The state could impose a tax on the value of land, maybe even land above a certain value. This would encourage efficient uses of high value land in cities, while dealing with land monopoly issues.

Income Tax Hike. This one is politically tricky, but Arizona voters just voted to hike top income tax rates for school funding. This shows that voters are willing to increase taxes if the material benefits are a lot less direct than a direct cash transfer. Polling from Alaska suggests voters would be willing to see an increase in their income taxes to keep the APF.

Having several different revenue streams would be best to help deal with economic fluctuations. We might even want to consider doing a large, one-time tax to help initially capitalize the fund.

The Payout

In Alaska, the dividend is set by a formula, but in recent years legislative action has been taken to alter the amount paid out. Similarly, the Sunshine Fund, would have a set formula that would take a portion of the fund’s annual gains, reinvest a set amount, and then pay out the rest to every resident of the state.

The fund could payout small, targeted amounts the first few years of operation as it grows. Eventually, the goal should be to shoot for an annual dividend of at least $1,000 per resident. Like with Alaska PFD, children should be eligible, with their dividend payment going to their parent or guardian.

If we’re concerned about the wealthier folks getting checks, you could tweak the upper income tax rates to phase out the check amount. Perhaps it could initially be used as a child allowance, with the dividend expanded to more people as the fund grows.

Investing

The fund would be professionally managed and invested with the goal of long-term growth and stability. A portion of the fund could be mandated to invest in certain things that are in the public interest. The APF requires that if an Alaskan investment has similar risk and return to an out-of-state investment, the Alaskan investment should be preferred.

There’s also a case for the Sunshine Fund buying up shares of publicly traded corporations that play an outsized role in lives of Arizonans. For example: utilities. Pinnacle West—the parent company of APS—is a corporation that could stand to be further reigned in, and Arizonans would benefit beyond the check they would be getting.

Being a shareholder in a corporation accrues voting rights, and as the Sunshine Fund becomes a larger shareholder, it should exercise these voting rights in the public interest. In the case of Pinnacle West, it could push the utility on climate change and election spending. A similar case could be made for telecom companies that operate in Arizona, the Fund could push them for better rates and services for costumers.

This is similar to what is already done by the Norwegian Government Pension Fund, the largest sovereign wealth fund in the world. It publishes a set of guidelines, used to guide how it votes in shareholder matters. These take into account transparency and sustainability, as well as other factors.

A Better Tomorrow, Tomorrow

I’m not optimistic that anything like the Sunshine Fund will be set up in the near future, but it’s worth noting that Alaska created their fund through a constitutional referendum. Maybe that’s possible here, maybe not. But it’s worth thinking about a way to make the average person a real stakeholder in the economy. A way that has already been tried and successful in practice.

The opinions expressed in this blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. It is only intended to provide education about the financial industry. The views reflected in the commentary are subject to change at any time without notice. And so on and so forth.

Like not putting your money into Reddit Select™ securities.

There are several requirements for eligibility. It can be summed up as: “live in the state most of the year and don’t be in prison.”